Set up payroll accounting #

Store wage types #

Above all, the wage types must be stored under Time type settings(Time recording → Settings → Time types):

- Salary (gross wage) monthly and hourly

- Salary (gross salary) % half / full year – e.g. 13th salary

- Wage supplements not tax-relevant – e.g. expenses, child and education allowances, daily accident allowance,

- Wage supplements (percentage) relevant to tax – e.g. vacation pay,

- Salary deductions as a percentage / fixed value – such as AHV/IV/EO contribution, ALV contribution, NBUV, occupational accident, daily sickness allowance, pension fund, withholding tax

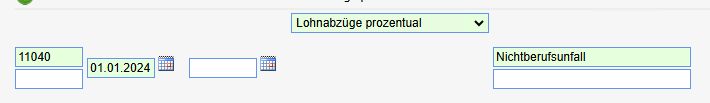

The wage type number is entered first, followed by the from date, the wage type type selected from the list and the name of the time type.

You can make the time type accessible for certain employee types (monthly and hourly wage earners and external personnel):

Enter the employee’s private data #

The private address is mandatory.

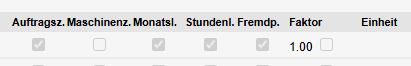

The social security number must also be entered in the master data.

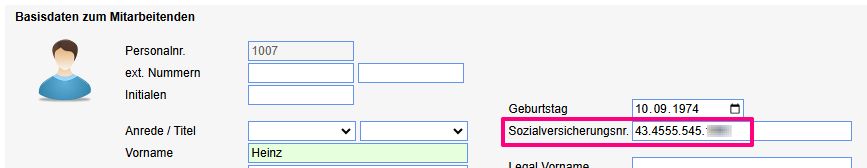

The IBAN should be entered so that a payment can be made.

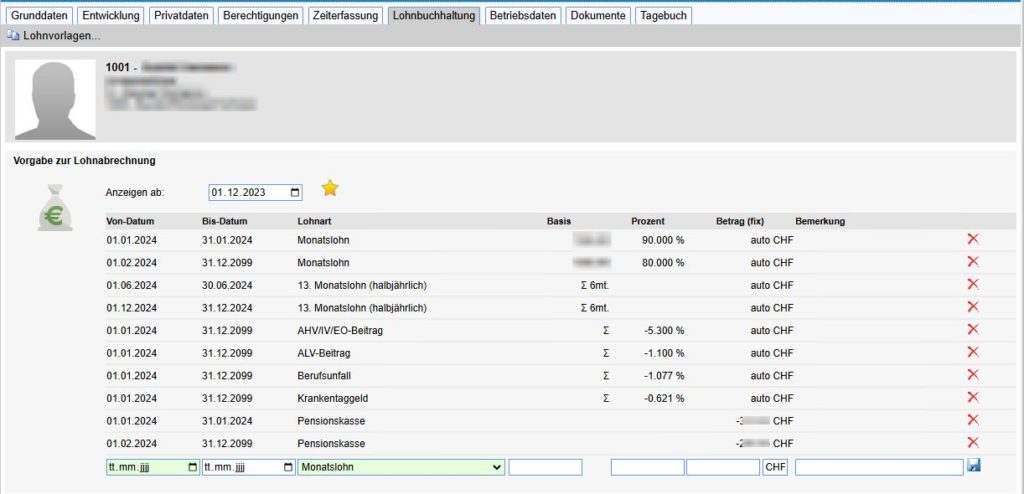

Store the payroll data with the employee #

The payroll data must then be entered for each employee. In particular, the salary must be entered. The wage supplements and deductions are calculated automatically according to this amount.

Create payroll accounting #

As soon as the master data has been created, the regular payroll runs can now take place.

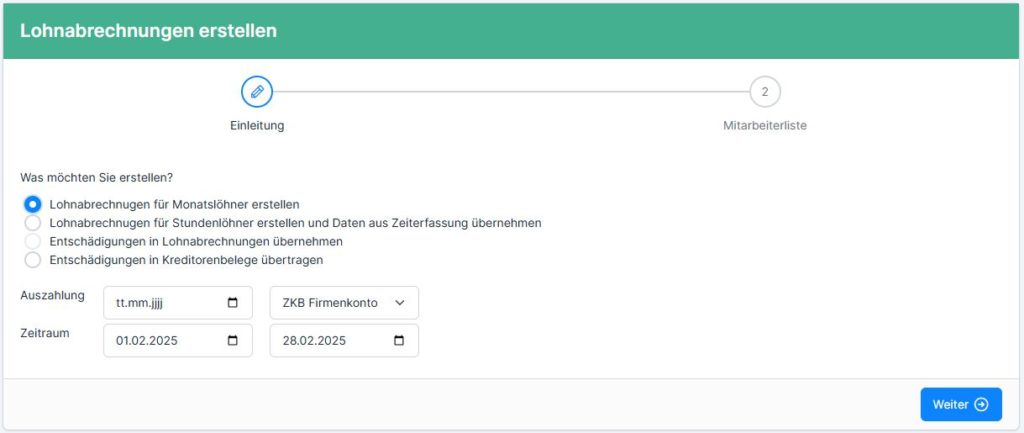

Start a monthly payroll run (“+New” symbol in payroll accounting).

The wizard appears to help you create payslips. The first step is to select the desired operation, the period and the payment date.

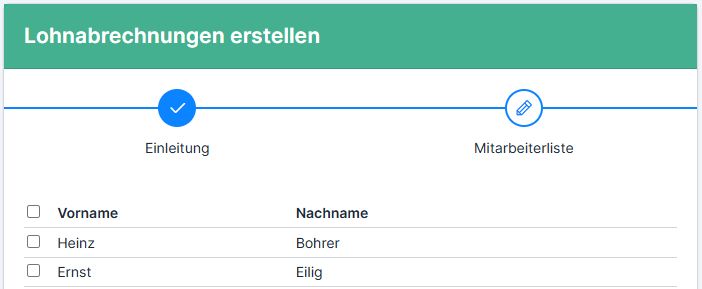

The second step is to select the employees.

It is currently possible to start the pay run several times for the same employee.

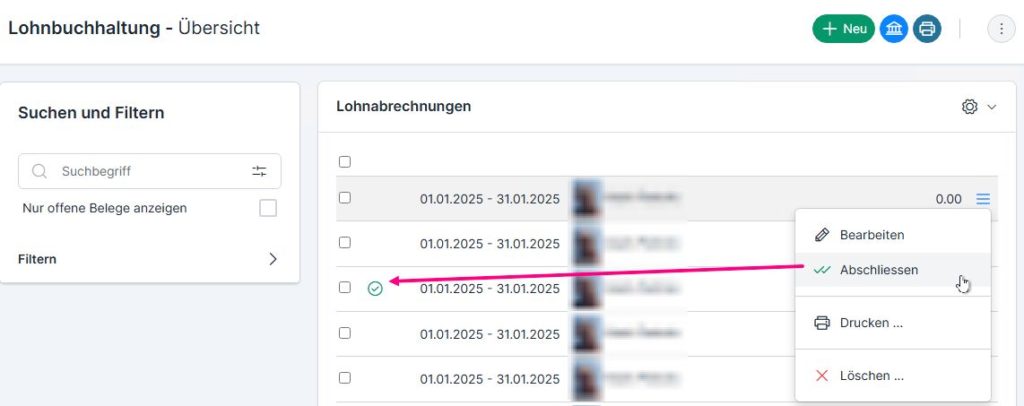

The payroll statements prepared must be checked and corrected if necessary, after which they must be finalized.

The created bank details are “uploaded” to the bank for payment.